Financial planning is a crucial aspect of your life that often gets overlooked in the hustle and bustle of daily responsibilities. It serves as a roadmap, guiding you toward your financial goals and helping you navigate the complexities of managing your money. By understanding the importance of financial planning, you can take control of your financial future, ensuring that you are prepared for both expected and unexpected events.

This proactive approach allows you to make informed decisions, allocate resources wisely, and ultimately achieve a sense of financial security. Moreover, financial planning is not just about crunching numbers; it encompasses a holistic view of your financial health. It involves assessing your current situation, identifying your goals, and creating a strategy to reach those goals.

Whether you are saving for retirement, planning for a child’s education, or simply trying to manage day-to-day expenses, having a solid financial plan in place can help you prioritize your spending and make better choices. By recognizing the significance of financial planning, you empower yourself to take charge of your financial destiny.

Key Takeaways

- Financial planning is crucial for achieving long-term financial stability and success.

- Setting clear financial goals and objectives is essential for creating a roadmap to financial success.

- Creating a budget and tracking expenses helps in managing finances effectively and avoiding overspending.

- Building an emergency fund is important to cover unexpected expenses and financial emergencies.

- Investing for the future is key to building wealth and achieving financial goals.

Setting Financial Goals and Objectives

Setting financial goals is an essential step in the financial planning process. It provides you with a clear direction and purpose for your financial decisions. When you establish specific, measurable, achievable, relevant, and time-bound (SMART) goals, you create a framework that helps you stay focused on what truly matters.

For instance, if your goal is to save for a down payment on a house, breaking it down into smaller milestones can make the process less overwhelming and more manageable. In addition to short-term goals, it’s vital to consider long-term objectives as well. These might include retirement savings or funding your children’s education.

By envisioning where you want to be in the future, you can align your current financial habits with those aspirations. This alignment not only motivates you to stick to your plan but also helps you make informed decisions about investments and savings strategies that will support your journey toward achieving those goals.

Creating a Budget and Tracking Expenses

Creating a budget is one of the most effective tools at your disposal for managing your finances. A budget acts as a blueprint for your spending habits, allowing you to allocate funds to various categories such as housing, groceries, entertainment, and savings. By taking the time to outline your income and expenses, you gain a clearer understanding of where your money is going each month.

This awareness can help you identify areas where you may be overspending and make necessary adjustments. Tracking your expenses is equally important in this process. By keeping a close eye on your spending patterns, you can pinpoint trends and make informed decisions about where to cut back or reallocate funds.

There are numerous apps and tools available that can simplify this task, making it easier than ever to stay on top of your finances. Regularly reviewing your budget and expenses not only helps you stay accountable but also empowers you to make proactive changes that align with your financial goals.

Building an Emergency Fund

An emergency fund is a financial safety net that can provide peace of mind during unexpected situations such as job loss, medical emergencies, or urgent home repairs. Building this fund should be a priority in your financial planning journey. Ideally, aim to save three to six months’ worth of living expenses in a separate account that is easily accessible but not too tempting to dip into for non-emergencies.

Establishing an emergency fund requires discipline and commitment. Start by setting aside a small amount each month until you reach your target amount. You might consider automating this process by setting up automatic transfers from your checking account to your emergency fund.

This way, saving becomes a seamless part of your routine rather than an afterthought. Knowing that you have funds set aside for emergencies can alleviate stress and allow you to focus on other aspects of your financial life.

Investing for the Future

Investing is a powerful way to grow your wealth over time and secure your financial future. While saving is essential, relying solely on savings accounts may not yield the returns necessary to keep pace with inflation or achieve long-term goals. By investing in stocks, bonds, mutual funds, or real estate, you can potentially earn higher returns on your money.

Before diving into the world of investing, it’s crucial to educate yourself about different investment options and strategies. Consider factors such as your risk tolerance, investment horizon, and financial goals when making decisions. Diversification is also key; spreading your investments across various asset classes can help mitigate risk while maximizing potential returns.

As you embark on this journey, remember that investing is not just about making money—it’s about building wealth that can support your lifestyle and aspirations for years to come.

Managing Debt and Credit

Managing debt effectively is an integral part of maintaining good financial health. High levels of debt can hinder your ability to save and invest for the future, so it’s essential to develop a strategy for paying it down. Start by assessing all of your debts—credit cards, student loans, mortgages—and prioritize them based on interest rates and balances.

Focus on paying off high-interest debts first while making minimum payments on others. In addition to managing existing debt, it’s important to maintain a healthy credit score. Your credit score affects everything from loan approvals to interest rates on mortgages and credit cards.

To improve or maintain your credit score, pay bills on time, keep credit card balances low relative to their limits, and avoid opening too many new accounts at once. By being proactive about managing debt and credit, you can create a solid foundation for your financial future.

Protecting Assets with Insurance

Insurance plays a vital role in protecting your assets and ensuring that you are financially secure in the face of unforeseen events. Whether it’s health insurance, auto insurance, homeowners insurance, or life insurance, having adequate coverage can safeguard you against significant financial losses. Assessing your insurance needs is an essential part of financial planning; it helps you identify potential risks and determine the appropriate level of coverage required.

When selecting insurance policies, it’s important to shop around and compare options from different providers. Look for policies that offer comprehensive coverage at competitive rates while also considering factors such as deductibles and claim processes. Regularly reviewing your insurance policies ensures that they remain aligned with your current circumstances and needs.

By prioritizing insurance as part of your financial strategy, you can protect yourself and your loved ones from unexpected hardships.

Seeking Professional Advice and Guidance

While self-education is invaluable in managing personal finances, seeking professional advice can provide additional insights and expertise that may be beneficial in achieving your financial goals. Financial advisors can help you navigate complex topics such as investments, tax strategies, retirement planning, and estate planning. They bring experience and knowledge that can help tailor a plan specifically suited to your unique situation.

When choosing a financial advisor, consider their qualifications, experience, and fee structure. Look for someone who understands your values and goals while also being transparent about their services. A good advisor will not only provide guidance but will also empower you to make informed decisions about your finances.

By collaborating with a professional, you can enhance your financial literacy while ensuring that you’re on the right path toward achieving long-term success. In conclusion, taking control of your finances through effective planning is essential for achieving both short-term stability and long-term prosperity. By understanding the importance of financial planning, setting clear goals, creating budgets, building emergency funds, investing wisely, managing debt responsibly, protecting assets with insurance, and seeking professional guidance when needed, you position yourself for a secure financial future.

Embrace these principles as part of your journey toward financial empowerment; the rewards will be well worth the effort.

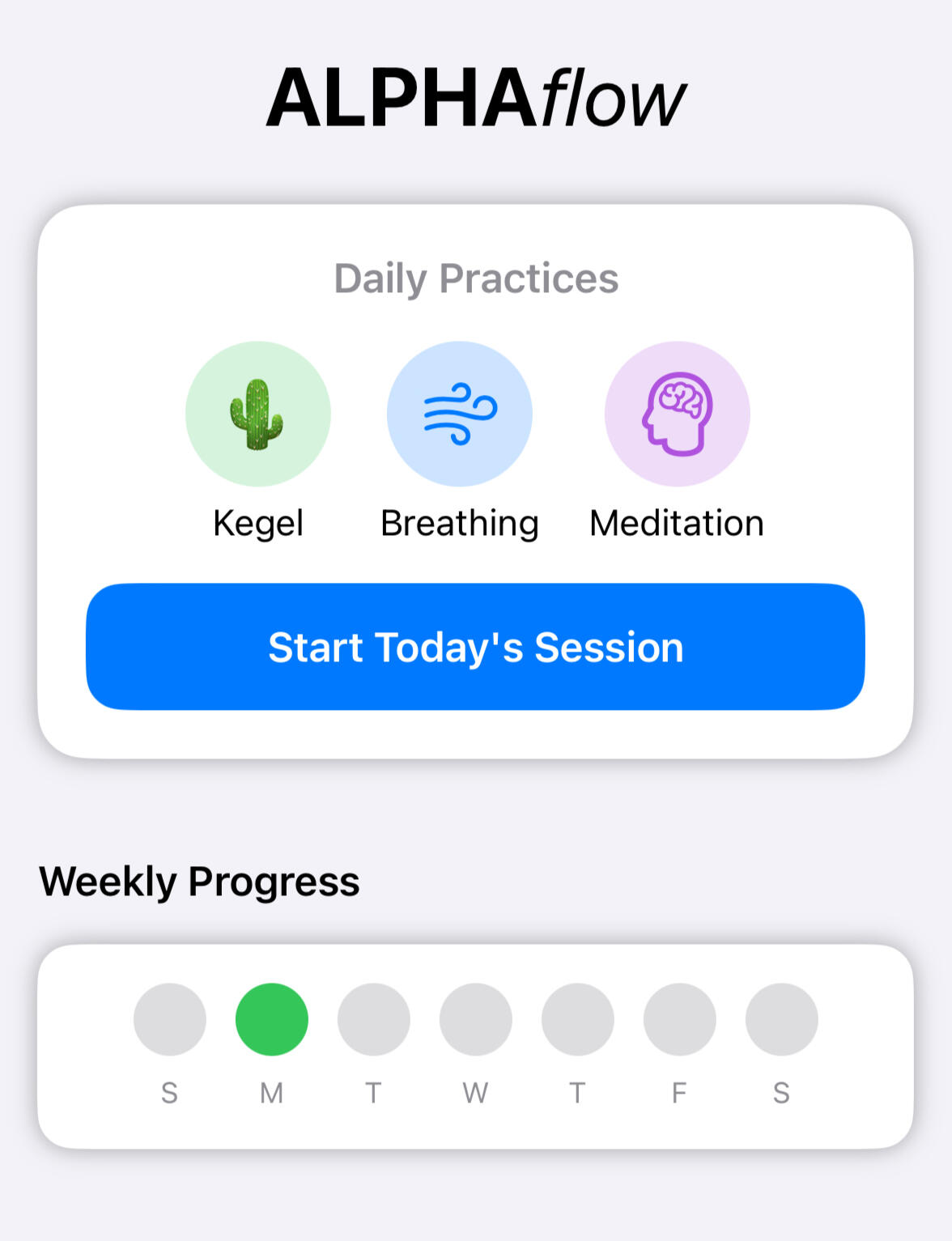

Financial planning is crucial for men to achieve peace of mind and secure their future. One important aspect of financial planning is investing in real estate, which can provide a stable source of passive income. AlphaFlow offers valuable insights and resources on real estate investing through their blog. For more information on how to diversify your investment portfolio and build wealth through real estate, check out their blog